Free economic zones are part ofthe customs territory of the Republic of Tajikistan.

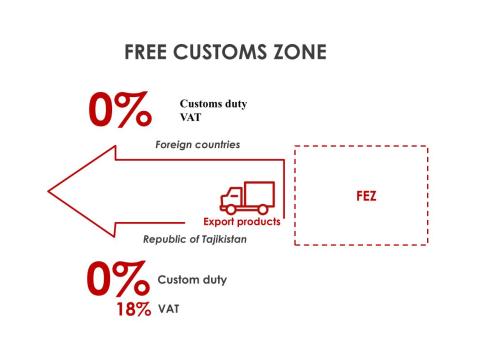

Goods placed on the territory of the FEZ RT are considered as being outside thecustoms territory of the Republic of Tajikistan, which allows you to importgoods from abroad without paying an import duty and VAT. Import of foreign and domestic goods,production and construction equipment to the territory of the FEZ is free ofcustoms duties and taxes.

When exporting goods from the territory of the FEZ outside the Republic of Tajikistan, taxes and customs duties are not levied, except for customsclearance fees, and economic prohibitions and restrictions are not applied.

exporting goods from the territory of FEZ to the territory of Tajikistan,customs duties are not levied, VAT is paid by the buyer.

Determination of the country of origin in relation to goods produced in the FEZand imported into it, is carried out in accordance with the legislation of theRepublic of Tajikistan and international legal acts recognized by Tajikistan.

OLD.FEZ.TJ

OLD.FEZ.TJ